How do stablecoins like Tether make money and operate?

How do stablecoins like Tether make money and operate?

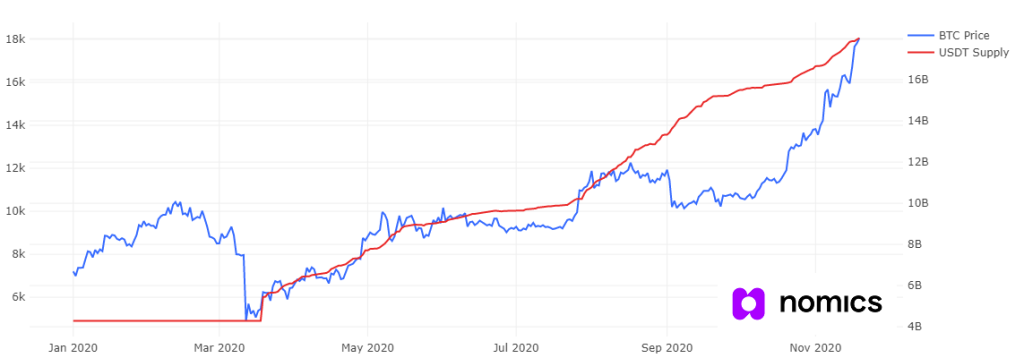

On March due to COVID-19 breakout, and the uncertainty on the global economy, there was a huge crash on the BTC price, $10K -> $4K As you can see on the chart since then, there was a huge spike on new fresh tethers. About $16 billion newly freshly mint that definitely supported it and drove it again past 10K. So how does their business plan work? Is there a bank that actually holds $20.000.000.000 in cash reserves + assets? How do they profit from the issuance of a stablecoin? (Do they offer it with interest on exchanges?) Are investors from our the world depositing in a bank account? Same questions stand for the others too like USDX, USDC, USDS